Options for Alpine to Pursue Economic Development and Sustain it Financially

The Alpine Business Alliance is looking into EDCs and MDDs as options for economic development. Either could be financed through the current sales tax if approved by voters in an election.

The Alpine Business Alliance has been focusing on two projects over the last few months. Members are split into 2 strategic groups, each focusing on one of the items below. This newsletter is an update on the second item as I’m placed with that group.

Procuring data from sources such as the Retail Coach to see where opportunities for economic development could be. This anonymized data can include cell phone locations and other public data.

Researching what organizational options are available for economic development and how they would be financed sustainably.

Some members of the second strategic group will be meeting with Eric Davis on January 5th. Eric is currently a councilperson in Jonestown, Texas and was previously a board member of the Texas Economic Development Council. As a consultant he’s helped other cities navigate the process of implementing economic development. There is no current cost or contract for his services, but Alpine may look to purchase them in the future if needed.

If you’d like us to ask Eric Davis any specific questions at the January 5th meeting or have ideas for economic development in Alpine, please add comments below or email me at ward3.nance@ci.alpine.tx.us.

Alphabet Soup - EDCs Versus MDDs

Economic development for municipalities in the state of Texas is typically done through EDCs (Economic Development Corporations) or MDDs (Municipal Development Districts). EDCs can be Type A or Type B, with smaller cities usually choosing Type B as they allow for funding opportunities for quality of life projects.

Type B EDCs can fund all projects eligible for Type A, as well as parks, museums, sports facilities and affordable housing. However, Type B EDCs are subject to more administrative restrictions than Type A.

MDDs are similar, but allow cities to take sales tax revenue from the ETJ (Extraterritorial Jurisdiction); the territory extending 1 mile outside of the city limits.

Marfa and Fort Stockton are examples of cities with EDCs, while Presidio has a MDD. Alpine currently has neither. A great overview, from the Texas Comptroller, of the economic development sales tax programs in Texas is below (22 minutes).

Information about economic development programs and assistance, beyond EDCs and MDDs, can be found at the Texas Comptroller website. This includes options such as tax abatement and the popular use of Chapter 380 agreements.

Chapter 380 of the Local Government Code authorizes municipalities to offer loans and grants of city funds or services at little or no cost to promote state and local economic development and to stimulate business and commercial activity.

Economic Development Financed Through Sales Taxes

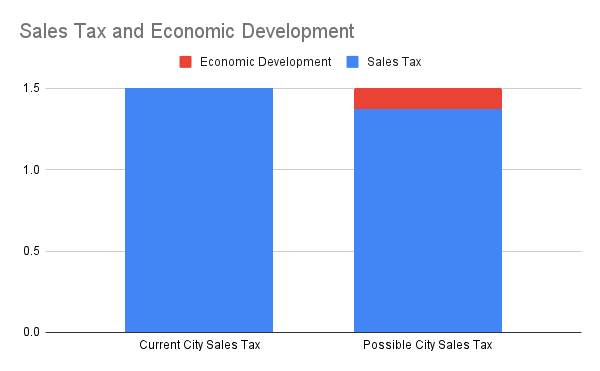

These organizations (EDCs and MDDs) are financed through sales tax revenue. The state of Texas allows a maximum sales tax rate of 8.25%. Of this amount, 6.25% goes to the state of Texas. That leaves a maximum amount of 2% that local governments can choose to impose. The City of Alpine and Brewster County currently have this at the maximum 2% within the city limits. It cannot go higher.

Of this 2% total, 1.5% goes to the City of Alpine and 0.5% goes to Brewster County. An example provides clarification. If you (or a tourist) buys dinner for $100 in Alpine, the total cost would be $108.25 after taxes. Of that $8.25 in taxes, the state of Texas will receive $6.25, Alpine will receive $1.50, and Brewster County will receive $0.50.

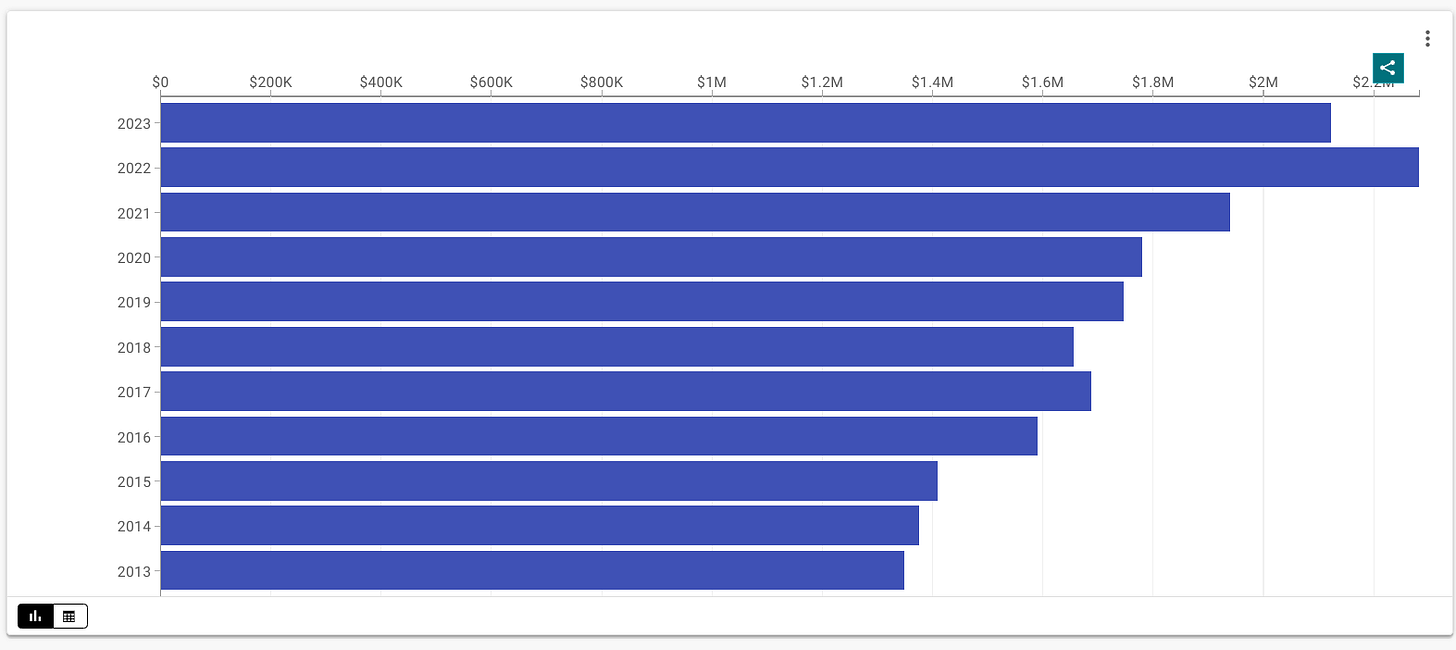

How much revenue does this bring into the City of Alpine? Below is a graph showing sales tax growth over the last 10 years. The chart is from the Texas Open Data Portal.

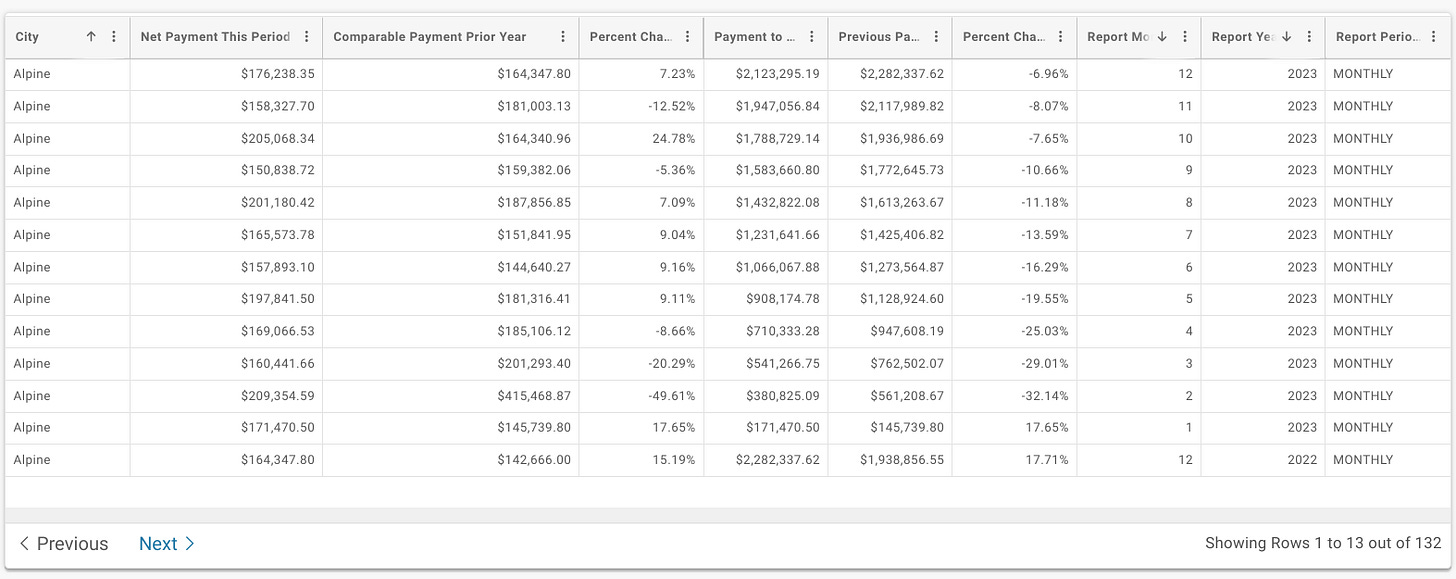

Within 10 years the amount of sales tax revenue going to the City of Alpine has increased from approximately 1.4 million to 2.1 million. This money goes into the ‘General Fund’ of the city budget, helping pay for the municipal court, police, fire, building services, roads, animal control, parks, HR, finance, and city leadership. Specific numbers can be seen below, which show how much sales tax has grown this year, on a month to month basis.

So how much total sales are occurring within the city limits to generate this 2 million in sales tax? Doing the math, $2,000,000 = 0.015 * (x) with x being the total sales revenue. The 0.015 represents the 1.5% the city receives from the 8.25% sales tax. Solving for (x), there are approximately 133 million dollars of sales occurring per year within the city limits.

Side Note: Brewster County receives 0.005 * $133,000,000 in sales tax annually. The 0.005 represents their 0.5% of the 8.25% sales tax. That means around $665,000 in sales tax revenue to the county comes from within the Alpine city limits.

How Can Alpine Finance Economic Development?

If the city decided to pursue an EDC or an MDD, they are required to put the issue on the ballot in an election. Anytime a change is made to how sales taxes are distributed, it must be put to the voters.

As mentioned above, Alpine is fortunate to have a growing sales tax base. In this year’s budget the city manager estimated an increase of around $150,000 in sales tax revenue. See page 8 of the proposed amended budget here.

Last year a total of 2 million was budgeted in sales tax revenue. This year 2.15 million is budgeted. An increase of $150,000.

The city can legally carve out 1/8 of a percent or more of their current 1.5% of the sales tax amount. One eighth (0.00125) of $133,000,000, the total sales revenue, is equal to around $167,000. This means an EDC or MDD could receive around $167,000 of funding based on an 1/8 percent sales tax and current sales revenue. This number is close to the estimated growth in sales tax for the city; i.e. $150,000.

In other words, the $150,000 from estimated growth in sales tax could be put towards economic development via a voter approved EDC or MDD, or by directly hiring an employee to focus on economic development.

There would be no increase in sales tax to the local citizen (or tourist) as it would be a carve out from the current 1.5% sales tax. The image below helps to explain.

Since EDCs and MDDs are tied to the tax rate, their funding can go up or down based on incoming sales revenues. In a growing economy, this means their funding will go up and improve if they bring in economic development; i.e. more sales.

If Voters Approve, What’s Next?

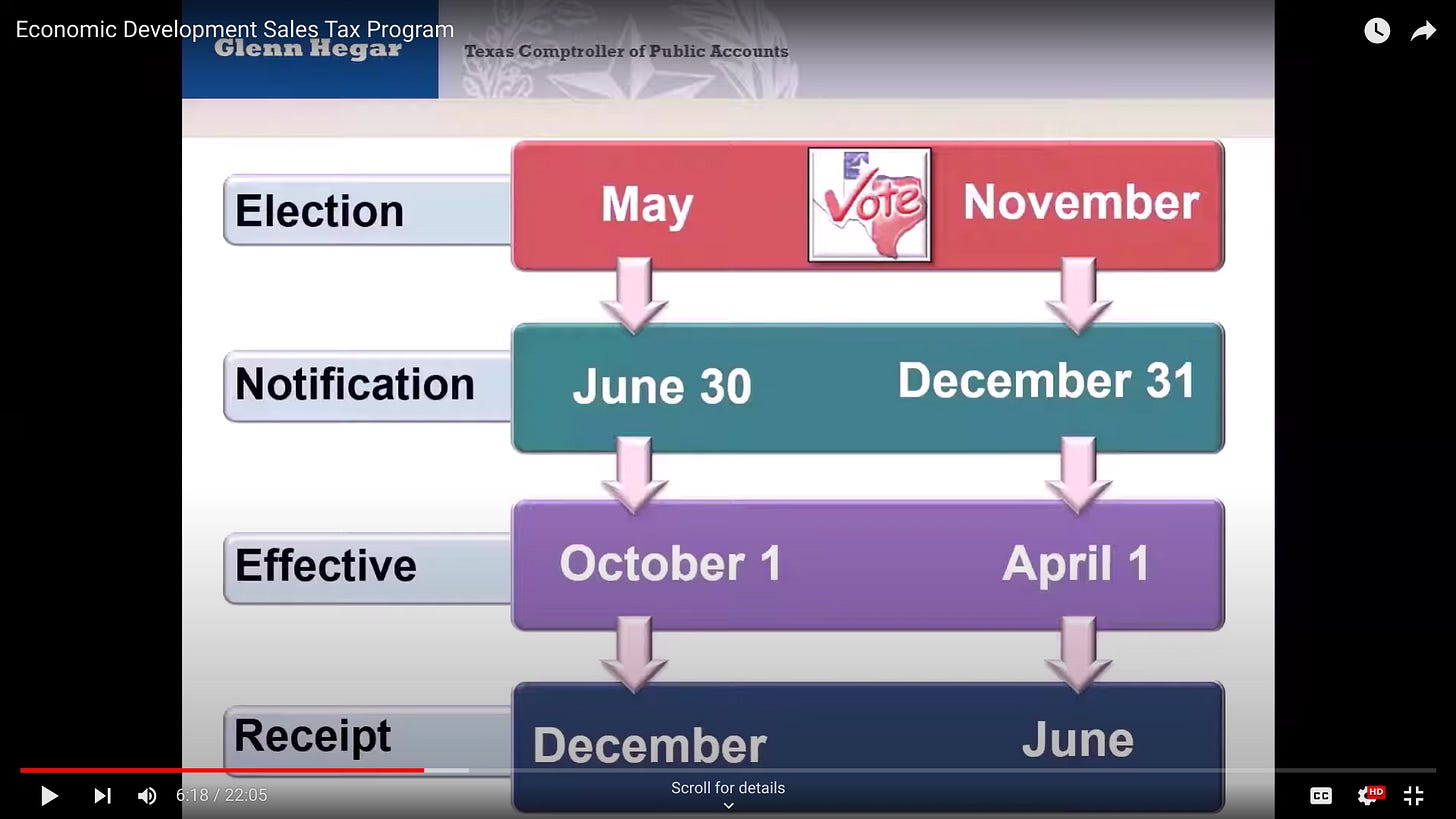

None of this would happen quickly. I don’t believe it could be on a ballot until November at the earliest. That means sales tax funding would not flow into the EDC or MDD until the following June, about a year and a half away - see image below.

If approved, a governing board would be created and they would hire an executive director to begin running the organization.

Side Note: Economic development could also be done by the city without an EDC or MDD. Since there is no “new” tax or tax increase, the city could simply earmark sales tax money to create an economic development position. No election would be required.

Possible Questions That Need to be Asked

Is an EDC or MDD going to pick winners and losers by helping some local businesses and hurting others?

An MDD could raise sales taxes for consumers and businesses outside of the Alpine city limits, as it has the authority to take in sales taxes in the ETJ (Extraterritorial Jurisdiction), 1 mile outside of the city limits.

My Quick Take

Economic development is a complex process. I believe a dedicated employee could help with the complexity of seeking grants and understanding Chapter 380 agreements.

Just can’t thank you enough for your work and leadership on this. I, too, am in favor of hiring a an economic development point person, in whatever configuration seems to make most sense fiscally and operationally for Alpine. I’m looking forward to learning all about the options as we all continue down this path.

Darin, you are such an incredible asset to Alpine and all of the residents. Thank you for all of the hard work you put in to make Alpine a better place. I am grateful for this substack because it has so much information that I haven't had time to look up. Keep up the great work.